Persimmon PLC - A recovery.

- Alexander Chandler

- Aug 8, 2023

- 6 min read

Simple big idea

Rising mortgage rates in the UK have resulted in drastically falling home sales. For homebuilders like Persimmon, Q1 2023 figures suggest that FY23 home sales could be > 50% lower than FY22. On a one-year basis, this is catastrophic. On a three-to-four-year basis, this could be an opportunity. As a leading UK homebuilder, Persimmon is positioned to disproportionately benefit from a UK housing market recovery.

1) Cooling UK inflation increases the probability of future interest rate cuts. This would put downwards pressure on mortgage rates, and help the housing market rebound in terms of average sale price and units sold.

Figure 1 – UK Inflation (YoY).

2) Decelerating UK Construction output is reducing UK housing supply growth, putting upwards pressure on the House Price Index (HPI) and therefore the average sale price of a home.

Figure 2 – UK Construction output (MoM growth %).

UK Mortgage approvals have been trending upwards during H1 2023. Recovering mortgage volumes support the UK HPI and home sales volumes.

Figure 3 – UK Mortgage approvals

We expect a gradual recovery in the UK housing market over the next 3-4 years, driven by falling mortgage rates. Buying UK homebuilders while they are currently priced for housing market turmoil may lead to future profits.

Key Risks

1) Interest rates stay higher for longer than our 3-4 year time horizon. This would be due to sticky inflation.

Risk mitigation:

1) Cash – Persimmon is a very cash-generative business (20% of revenues is FCF, 5Y average). This means that they have over GBP 800M of cash and equivalents on their balance sheet, allowing them to weather liquidity storms.

2) Profitability – Persimmon is a highly profitable business, averaging a 20% NIM over the last 5 years. Even with current housing market turmoil and an expected revenue decline of over 50% for FY23, management still expect the NIM to be ~15%.

3) Dividend – Persimmon currently offers a 5% dividend yield, and has the cash potential to sustainably offer a 20% yield in the long-term. This means that even if interest rates stay “higher for longer”, Persimmon shareholders will own a cash-generative asset.

Business overview

Persimmon Plc is a British residential property developer and one of the largest homebuilders in the United Kingdom. The company is known for constructing and selling new homes, ranging from affordable housing to luxury properties, across various regions in the UK

Industry

Growth: The UK residential construction industry is worth GBP 142B as of 2023. It is expected to grow at a low single-digit CAGR from 2023-2028. While this growth is not impressive, it is more the cash-generative capacity of the industry and its recovery that drives this thesis.

Profitability: The industry’s median Net Income Margin (NIM) is 12% as of Q1 2023. This margin is around 15-20% during periods of revenue growth. The durability of the NIM despite housing market turmoil suggests that UK homebuilders are resilient enough to ride out the current market conditions.

Regulatory backdrop: The UK Government has set a target for 300,000 new homes to be built each year. The industry has been able to produce ~250,000 new homes annually over the last few years. This shortfall evidences a lack of housing availability in the UK, which the Government is tackling with programs such as “Help to Buy”, offering interest free loans for five years to first-time buyers.

Market dynamics

Mortgage product volumes have almost doubled from lows seen in October 2022.

Mortgage rates have started to ease off the highs seen in Q4 2022.

This is good news for homebuilders, as more mortgages means greater home sales volumes.

Moat (competitive advantages)

1) Diversification. Persimmon operates 3 different brands at three different price points. The brands cater to low income, middle income, and upper middle-income customers respectively. This allows Persimmon to sell more high-value homes during housing market booms, but still retain its market when mortgage rates rise and buyers are looking for cheaper alternatives. As of 2023, Persimmon’s main business is their middle-income homes, accounting for over 80% of sales volume.

2) Cost. Persimmon is vertically integrated. It owns and operates its own brickworks, tileworks, and fabrication operations. This ensures access to critical supplies, while also granting cost advantages over competitors who must pay for market price construction materials. This slight cost advantage is reflected in Persimmon’s 5Y average NIM of ~20%, compared to comps such as Barrat Developments with ~14%.

Market perception

Persimmon’s market valuation is down -36% YoY at the time of writing. This reflects a negative market perception around the struggling UK housing market during a time of elevated interest rates.

While this view is justified in the short-term, with negative sales volume growth, we do not believe it reflects the long-term value of the company.

We believe that as inflation eases and interest rates reach their peak, investor interest in the UK housing market may pick back up as home sales volumes recover through higher mortgage approvals.

Financial analysis

In the past few years (ex. Covid), Persimmon averaged 7% annual revenue growth. It maintained a steady profit margin of ~20%, and is best described as a “cash cow”.

The key driver of growth over the next 3-4 years is expected to be the effect of falling interest rates on mortgage rates, increasing mortgage approvals and home sales volumes.

In the near-term, we expect a -41% reduction in Persimmon’s revenues. This is in line with management guidance on unit sales for the year of 8000-9000 units, and with Q1 2023 data of -50% forward sales growth.

It is this near-term turmoil that has prompted the stock to be sold down over 30% YoY.

However, we expect a recovery in Persimmon’s earnings by FY26, aided by easing inflation and a more stable housing market.

Although we forecast operating expenses to grow at a ~8% rate from FY24 – 26, this is a conservative estimate, as construction supply inflation has been decelerating in line with headline inflation figures.

Core assumptions

Unit volume:

Q1 2023 sales rates imply 8-9k units sold for the year, with forward sales down 50% from 2022. Management expects sales to be towards the upper end of that range as mortgage approvals pick up, mortgage rates trend downwards, and inflation eases.

Management expects a return to volume growth in 2024, driven by easing interest rates.

Unit price:

FY decline from Q1 Average price of 276k.

Profitability:

Operating leverage as build cost inflation decelerates.

House prices recover due to lower supply growth, interest rate cuts.

Management guidance of 15% NIM.

Management guidance of margin expansion in 2024 and beyond.

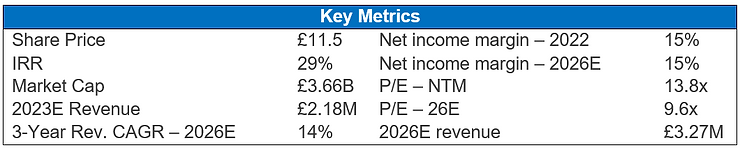

Valuation

IRR

Our base case IRR is 24% (ex. Dividend) and 29% including dividends.

This is underpinned by the following assumptions:

An elevated 14% 2023-26 revenue CAGR resulting from falling interest rates and recovering mortgage volumes. This affects the simultaneous house price value and sales volume increases forecast in the earnings forecast table.

A 21% NIM, in line with Persimmon’s long-term average, in the event of property market stabilization.

The bear case of 4% IRR reflects a meagre 5% FY23-26 revenue CAGR.

This may occur in the event of easing inflation taking pressure off of consumer savings, but the Bank of England refusing to materially cut interest rates.

The bull case of 36% IRR reflects a strong property market rebound with a 16% revenue CAGR, in the event of the Bank of England aggressively cutting interest rates, increasing home values and sales volumes.

The risk/reward ratio of this investment is favorable. Due to Persimmon’s robust profitability and its ability to generate cash to distribute a material dividend, even if the bank of England decides not to cut rates there is still potential upside of 4% IRR + a 5% dividend yield (9% IRR).

Comps table

The median P/E ratio for Persimmon’s comps is 8.6x. Persimmon currently trades at a premium, 13.8x. This is due to its superior consensus growth rates (26E of 10% revenue growth vs 5% for comps), and cash generation (~20% of revenues vs 8% for comps, 5Y avg).

We assume that Persimmon de-rates from 2023-26, shedding its premium valuation and being priced like comps at 9.3x earnings. This is because competitors such as Barrat Developments and Taylor Wimpey are expected to have similar growth and profitability profiles.

Despite these conservative assumptions, we anticipate a base case IRR of ~30%, including dividends.

Bonus prize

Persimmon recently cut their dividend to 60 pence / share due to market turmoil. This still provides a 5% dividend yield. With historical payout habits of close to 100% of earnings, and a recovery in market conditions, Persimmon has the capacity to pay 235 pence / share: a 20% dividend yield on today’s prices.

This demonstrates Persimmon’s favorable valuation, and cash-cow status. Management has expressed desire to “grow the dividend over time” from 60 pence back towards its former amount. This will increase the dividend yield and therefore Persimmon’s appeal to investors.

Stock Performance

*DISCLAIMER: This article is not financial advice. All views are expressed in the context of research and education. Lion Research does not provide recommendations to readers on whether to buy or sell the securities or investments covered.

Comments